tax avoidance vs tax evasion uk

In the uk income tax evasion may result in a maximum penalty of seven years in jail or an unlimited fine. It always creates a lot of anger and questions about how to get away with.

Irs Goes Undercover And The Movement Against Corp Tax Avoidance Htj Tax

It is the illegal practice.

. Tax avoidance is structuring your affairs so that you pay the least amount of tax. Fraudsters who carried out a 100 million tax avoidance fraud have been sentenced to 27 years in prison. Usually tax evasion involves hiding or misrepresenting income.

Tax evasion is a felony. In the UK income tax evasion may result in a maximum penalty of seven years in jail. Tax avoidance has always created interesting news.

In the uk income tax evasion may result in a maximum penalty of seven years in jail or an unlimited fine. Tax evasion on the other hand is using illegal means to avoid paying taxes. Tax evasion is ILLEGAL.

Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid paying tax. Avoiding tax is legal but it is easy for the former to become the latter. The difference between tax avoidance and tax evasion essentially comes down to legality.

The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. It even makes big news for celebrities and large multinationals.

The difference between tax evasion and tax avoidance largely boils down to two elements. Whether its famous musicians footballers or global businesses in recent years HMRC have made it a priority to clamp down. This is much easier to define as to have.

Tax avoidance may exist in a controversial area of the tax system but tax evasion most definitely doesnt. Its as simple as that. In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B.

The tax evasion vs tax avoidance debate is a long-standing one. But some businesses and individuals go much further to minimise their tax liabilities which can give rise to accusations of tax avoidance if not blatant tax evasion. According to most recent.

On 16 Feb 2022. Tax planning either reduces it or does not increase your tax. In the uk income tax evasion may result in a maximum penalty of seven years in jail or an unlimited fine.

Any attempt to evade or defeat a tax is punishable by up to 250000 in fines 500000 for corporations five years in prison or a combination of the.

How Global Tax Dodging Costs Lives New Research Shows A Direct Link To Increased Death Rates

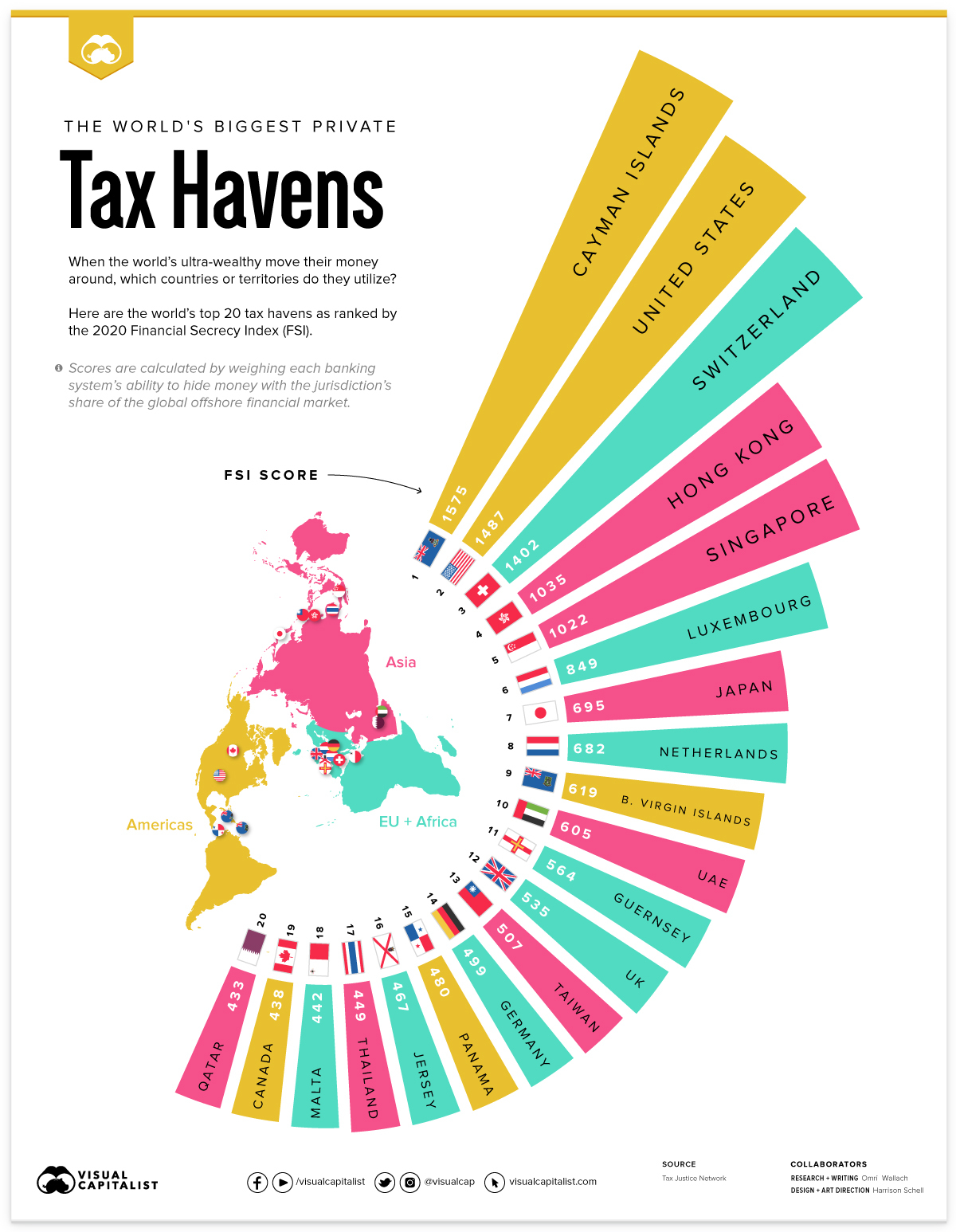

Mapped The World S Biggest Private Tax Havens In 2021

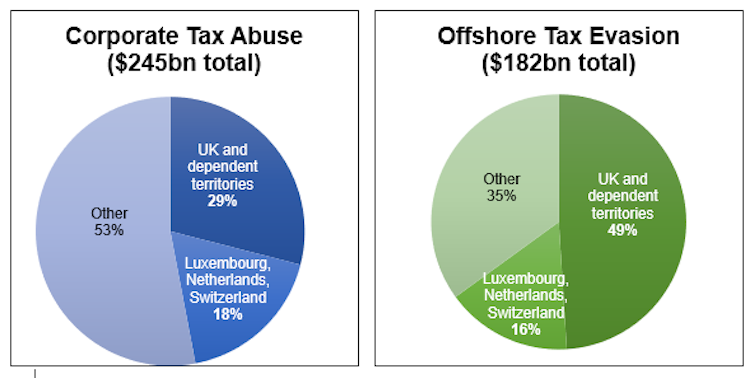

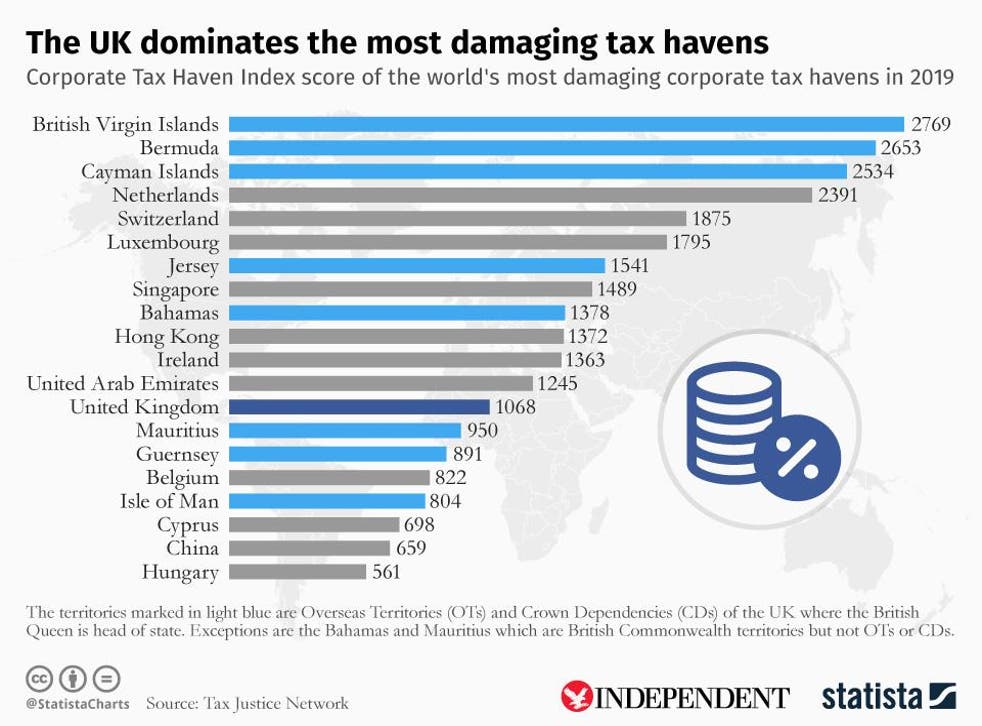

Eu Loses Over 27 Billion In Corporate Tax A Year To Uk Switzerland Luxembourg And Netherlands Tax Justice Network

Tax Avoidance Is Not Tax Evasion But Try Telling Politicians Private Banking Asset Protection And Financial Freedom

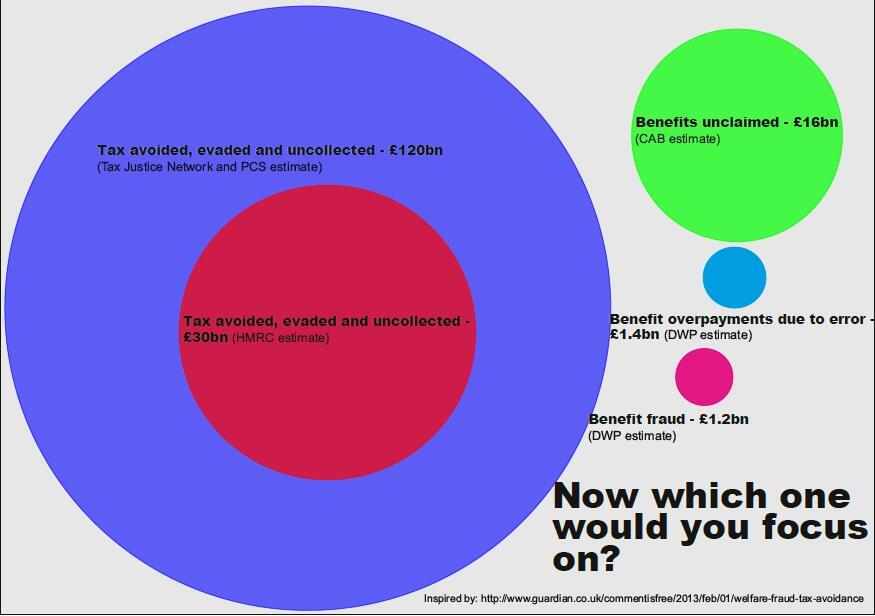

Tax Evasion Vs Benefit Fraud R Ukpolitics

Concept Of Tax Evasion Tax Avoidance Definition And Differences

The Role Of Parliament In Reducing Tax Evasion And Avoidance Ppt Download

The Other Side Of Amazon S Apple S And Google S Tax Evasion Baekdal Plus

How Do You Solve A Problem Like Tax Avoidance What S The Scale Of The Problem Waiting For Godot

Simon Griffiths On Twitter Cost Of Tax Avoidance Evasion Vs Benefits Fraud Https T Co Mm8efwb3ot Via Newsframes Twitter

Uk By Far The Biggest Enabler Of Global Corporate Tax Dodging Groundbreaking Research Finds The Independent The Independent

Tax Avoidance Vs Tax Evasion Infographic Fincor

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

Tax Evasion And Tax Avoidance Definitions Differences Nerdwallet

How Multinationals Avoid Taxes In Africa And What Should Change

Ending Offshore Profit Shifting Oecd

Tax Evasion V Tax Avoidance Is There A Difference Pace International Law Review